In response to Senator Bong Go’s appeal for GSIS to help its members and pensioners, Government Service Insurance System (GSIS) President and General Manager Rolando Ledesma Macasaet today assured the public that the state pension fund will extend all the necessary assistance to its members and pensioners.

Senator Go, who chairs the Committee on Health and Demography, specifically asked GSIS to (1) waive penalties for delayed remittances, (2) release pensions early and (3) grant emergency loans.

“Nagpapasalamat po kami sa concern ng ating butihing Senador para sa kalagayan ng aming mga miyembro at pensionado. Nais ko pong ipabatid kay Senador Go na nagawa na po ng GSIS ang dalawa sa tatlong kahilingan niya. Una, nagbigay na po kami ng extension o ‘grace period’ sa lahat ng premium remittances at loan payments na dapat bayaran nitong Marso. Puwede po itong bayaran sa May 10 na walang karampatang penalty,” Macasaet said.

GSIS likewise extended the due date for housing loan payments and rental payment for investment properties falling due this March. “Babayaran din po ito sa May 10 na walang penalty,” Macasaet said.

“Para naman po sa mga pensyonado, maaga po nilang matatanggap ang mga pensyon nila ngayong Abril. Karaniwan po sa April 8 dumadating ang pensyon. But we will release it before April 8,” the GSIS chief added.

“Doon naman po sa Emergency Loan, maglalabas po ang GSIS ng emergency loan para sa aming mga myembro at pensionado. Humihingi lang po kami ng konting panahon dahil inaayos namin yung aming systems para ma-activate ang nationwide implementation nito.”

GSIS offers a Php20,000 emergency loan to active members and pensioners with an interest rate of 6%, payable in three years.

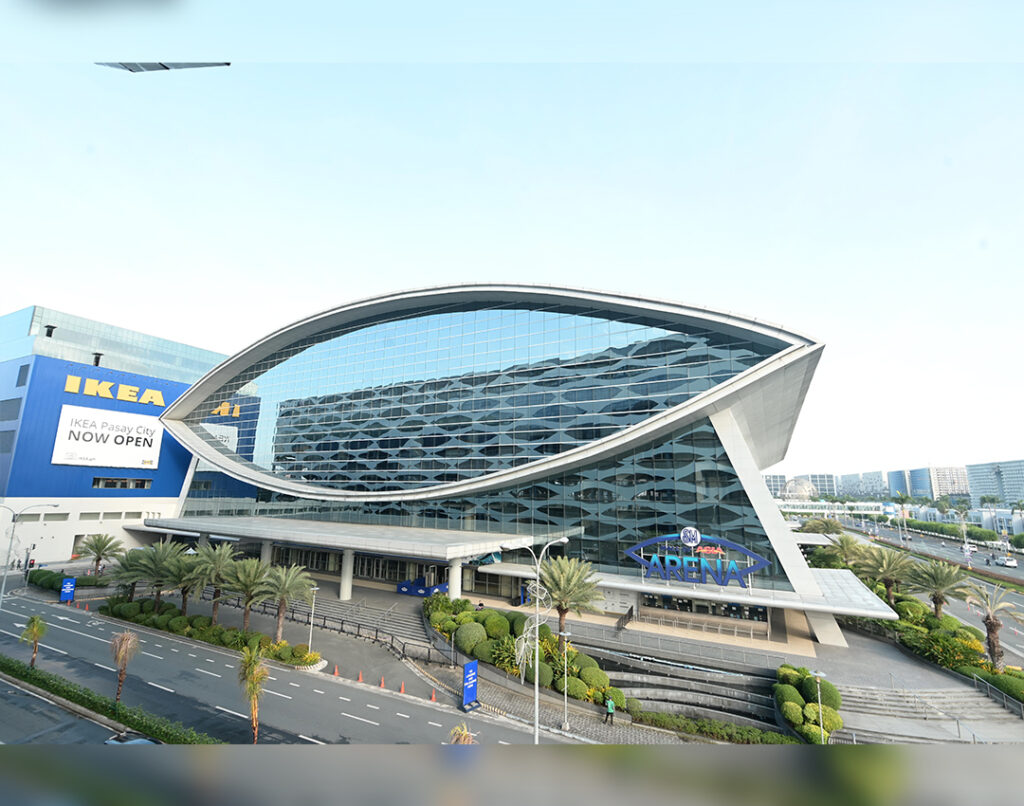

At present, all GSIS offices nationwide are closed to the public until 12 April 2020. However, GSIS continues to accept loan applications for Conso-loan, Policy Loan and Pension Loan through the GSIS kiosks. GSIS has nearly 1,000 kiosks installed in government agencies, GSIS branch offices, provincial capitols, city halls, and municipal offices as well as selected SM and Robinsons malls all over the country. Loan applications of active members require prior approval by Agency Authorized Officers or Liaison Officers (AAOs / LOs) before GSIS can credit the loan amount to the individual borrower’s account.

124

124